Building a Financial Foundation in the Bay Area

Current Financial Reality in America

Retirement Reality

- The average age for retirement in America is 66

- According to Social Security Administration, a healthy 65 years old woman has a high probability of living until the age of 86.

- A healthy 65 years old man has a good chance of living until age 84.

- The majority of Americans aren't ready for retirement.

America Financial Reality

- 40% of Americans have less than $300 in savings.

- 50% of Americans have less than $600 in savings

- 57.4% of Americans have less than $1000 in savings

- In the $0-$300 savings range, 45% of people are females while 29% are males.

* Based on GoBankingRates survey

Long Term Care (LTC) Statistics

- 70% of retirees will need some form of (LTC) in their lifetime.

- The median costs for LTC ranged from $53,768 to $105,850 per year in 2020 based on a survey by Genworth.

- Most long-term care costs will come from your savings or from Medicaid if you have no money available.

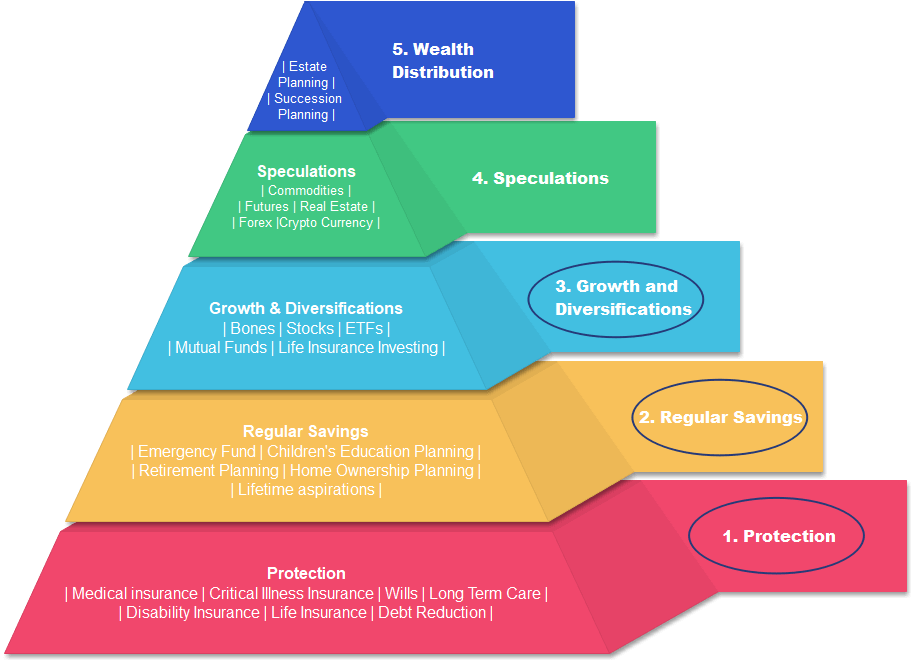

Financial Pyramid for Financial Planning Bay Area

Service Overview

Many Americans face uncertain future due to variety of factors. One of them is lack of financial literacy. While many of us learned many things from schools and colleges, but many did not learn how to manage money and how to plan for retirement.

There are multiple factors when choosing financial products or services in the current market. It is important you work with the right partner to help you navigate the complexity of these products while finding the most effective way to utilize them. It is important to work specialists vs. generalist in this space in order to maximize total benefits and return. At Bay Business Investments, we have access to specialists or team of experts that can show you the best solutions based on your current unique situation. We know each client has his/her own unique circumstances, and we will recommend solutions that are uniquely tailored for different situations. Our end goal is to help clients minimize or eliminate risks, fees and taxes. At end of the day, we want to work with you to properly build your financial pyramid.

It is important to have the proper building block built correctly as you set up your financial plan. One of the key financial tools is called Indexed Universal Life (IUL) since it can fulfill a number of areas on the financial planning pyramid. An IUL with living benefits can fulfill a number of requirements in steps 1, 2, and 3 of the financial pyramid.

One of the best ways to understand this important financial tool is a book called “The Financial Pocket knife: Beating the Dream Killers” by James L. Stoddard Jr. You can get the book here.

More Services for Building the Financial Pyramid

Family Financial Protection

Many things happen in life that’s out of our control. Do you have a plan to take care your loved ones if something happens to you? Will your family be ok? Do you have a plan to handle all the affairs?

Tax Saving and Planning

Many of us pay high taxes year after year. Are you aware there are financial options that can protect your family while also save you taxes on future investment earnings with downside investment protection?

Retirement Planning

Most people talk about retirement when they reach a certain age. However, retirement is not about reaching a certain age. Rather, it is about have a proper plan and adequate income. Do you have a plan for retirement?

Investment Management

Managing your own investment portfolio can be like going to the casinos if you are not an investment pro. With financial uncertainties at every turn, it is important to have the right team managing your hard earned money.

Long Term Care

Have you thought about long term care or LTC? 70% of Americans will need some form of LTC during their lifetime while only 31% think they need it. Many LTC situations aren’t covered by medical insurance. Are you prepared?

Critical Illness and Chronical Illness

Many things happen in life that’s out of our control. Are you ready for such events? Will there be enough money to pay for medical bills? Will your family be ok? Will you get the proper resources to be cared for? Do you have a plan for critical and chronical illness?

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

What is Indexed Universal Life or IUL?

Indexed Universal Life

One of the foundations of any sound financial plan is life insurance with living benefits. The life insurance industry has evolved over the years, and it is now possible to have living benefits from your life insurance policy with the proper add-ons. The indexed universal life insurance is a product that can fit the requirements.

Indexed universal life insurance is a type of permanent life insurance, which means it has a cash value component in addition to a death benefit. The money in your cash-value account can earn interest based on a stock market index chosen by your insurer, such as the S&P 500 or the Nasdaq Composite.

Below are some of the key features of an Indexed Universal Life (IUL) policy.

One of the hidden features of IUL (Indexed Universal Life) is the ability to apply an indexed strategy on your cash value in the IUL allowing you to gain interest based on the performance of the index, without any downside risk or volatility. There are many indexes top financial institutions use to calculate the performance, and this essentially allows you to invest in the market while not directly in the market. Another key feature of this strategy is that your gains based on the index are tax-free. Also, you have the ability to access your money 100% tax-free with no penalties, restrictions, or age limitations. This liquidity feature and the ability to access your fund easily are important factors to consider when saving for your retirement. The top 1% of wealth America has always used this feature for decades to grow their wealth, and it is becoming an important tool when it comes to retirement planning.

Below is a summary of the benefits of IUL (Indexed Universal Life)

- Tax-free growth based on indexed strategy

- Tax-free access to your funds

- Minimal downside even when the market is performing with negative returns

- Principal protection to your funds from mark volatility and risk

- Eliminate money management fees that are part of many wealth management products

- Growth of your cash value in the IUL can help pay for the insurance premium portion

- Greater peace of mind when saving for your retirement and the future

One of the key features of IUL is chronic illness insurance. Please note Medicare does not cover this type of care and if you don’t have access to this type of living benefit, you will have to pay this out of your own pocket.

This feature is built-in with many IULs or as an add-on in some others. You are eligible for Chronic Illness living benefits when your doctor can certify that within the last 12 months you are unable to perform at least two of the six Activities of Daily Living (ADLs) unassisted for a minimum of 90 days consecutively or you are cognitively impaired for minimal of 90 days.

These are the ADLs:

- Bathing: The ability to sponge bathe or get in and out of bathtub or shower.

- Eating: The ability to feed oneself by getting food into the body or by a feeding tube.

- Continence: The ability to maintain control of bladder and bowel functions.

- Toileting: The ability to get to and from the toilet and perform associated personal hygiene.

- Dressing: The ability to put on and remove all items of clothing and any braces or artificial limbs.

- Transferring: The ability to get in and out of bed, chair, or wheelchair.

- Chronicle Illness Qualification – Must be unable to perform 2 or more of the above.

One key difference between chronicle illness coverage vs. long term coverage is chronicle illness coverage usually only covers a percentage of the long term care coverage.

Many of us are potentially one doctor’s visit away from finding out we contracted a critical illness that can severely impact our earning potentials. In addition, experiencing a critical illness may be a huge financial burden to you and your family.

This is why it is important to have this kind of living benefit coverage for yourself as well as your family. The most basic critical illness or injury living benefits cover some of the most common illnesses and leading causes of death worldwide. Below are a list of these critical illnesses:

- Cancer

- Heart Attack

- Stroke

- Alzheimer’s disease

- Organ transplants

- Kidney failure

- Angioplasty

- Multiple sclerosis

- Cystic fibrosis

- Paralysis

- Severe burns

Long term care or LTC is an important add-on living benefit for many IUL (Indexed Universal Life) since the many health insurance policies simply don’t cover it, and the cost can be high and ongoing.

There are specific activities one must do on a daily basis in order to take care of oneself. These Activities of Daily Living (ADLs) are the following:

- Bathing: The ability to sponge bathe or get in and out of the bathtub or shower.

- Eating: The ability to feed oneself by getting food into the body or by a feeding tube.

- Continence: The ability to maintain control of bladder and bowel functions.

- Toileting: The ability to get to and from the toilet and perform associated personal hygiene.

- Dressing: The ability to put on and remove all items of clothing and any braces or artificial limbs.

- Transferring: The ability to get in and out of bed, chair, or wheelchair. A person qualifies for benefits when they are unable to perform two or three ADLs, depending on the long-term care insurance policy.

If one is unable to perform 2 out of any of the 6 ADLs above, they are potentially in a long-term care situation. In very simple terms, long term care is assistance for persons who can no longer perform these basic day-to-day activities on their own. Relevant to the elderly, the need for care can be due to the natural process of aging, a sickness, or the progression of Alzheimer’s, Parkinson’s disease, or another type of dementia.

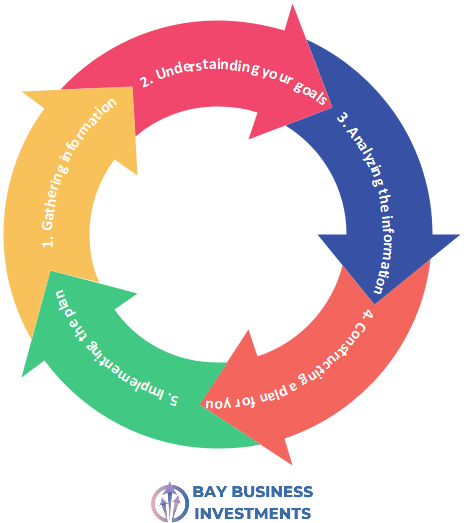

Bay Business Investments Financial Planning Process

Below are steps to our financial planning process:

- Gathering and discussing your current financial situation. We will help you fill out a form that will help us get to know your current financial situation and where you want to be when you retire.

- We will get an in-depth understanding of your financial goals for yourself and your family.

- We will be analyzing the financial information we have collected from you with our team of specialized and licensed professionals.

- We will construct a custom financial plan for you and your family based on the information we have collected and analyzed.

- We will work with you to implement the strategies in the plan. We will review this plan with you regularly to make sure everything is up-to-date.

Financial Foundation F.A.Q.

How do I retire?

Quitting your job or leaving your workplace can be as easy as filling out some paperwork with your HR department, but replacing your regular paycheck can be much more difficult without proper planning. The best way to do this is by sitting down with a financial professional and determining how much to pull out of your retirement accounts and on what schedule in order to sustain your retirement lifestyle. You are start the process by setting up an appointment with one of our professionals today.

When can I retire?

The short answer: you can retire when you want to stop working and can afford to do so. Retirement isn’t about when you reach a certain age, but it is about having enough to sustain your lifestyle when you stop working. There are a number of factors that you must take into consideration: your pension if you have any, your social security payment and when to start taking payments, your retirement income, and Medicare. People can start collecting social security checks starting at age 62 at earliest. Medicare doesn’t begin until age 65, meaning workers who receive health insurance through an employer may have to wait until then to retire.

How do I build an income stream for my retirement?

Your income in retirement is likely to come from a number of different sources and there a number of strategies to consider.

What will work for you will depend on your current situation, and through understanding what you need in order to retire.

It is important that you speak to the right financial professionals to get a proper financial check up. Based on the information collected, we can help you develop a plan to protect yourself, your family, and for retirement.

Do I need to reduce my debt before I can plan for the future?

It is important to understand your current debt situation. By understanding your debt situation, we can help you understand the impact of debt on your financial position now and in the future.

We will bring in other aligned professionals to help you restructure your debt. There is no one-size-fits-all commodity, and everyone has different financial goals requiring unique financial strategies.

It is always a good idea to review your financial strategies regularly with financial professionals in order to make changes based on the current situation and needs.

How much do I put in an emergency fund?

The answer is it depends on how much your life costs since everyone is different. As a good rule of thumb, you should have at least 6 to 9 months of your total living expenses (rent/mortgage payment, food, transportation, recurring monthing bills etc.) tucked away for emergencies. This way, if you suddenly lose your job or fall on hard times, you can still maintan your current lifesyle without racking up major debt.

It is important to have an emergency fund established before you fund things like a vacation.

Do I need to have a budget?

A budget gives you a clear understanding of how much money you are spending versus how much money you are making.

You should definitely have a budget since it will help you understand where you are financially.

Budgeting tends to help people feel more in control of their financial situation and money. If you feel you need control over your financial situation, then you need to have a budget.

Your Financial Foundation Future Starts Here

Address

Bay Business Investments

C/O Innocospace

155 Bovet Road

Suite 700

San Mateo, CA 94402

Click here to send us an email.